Global scale and strength

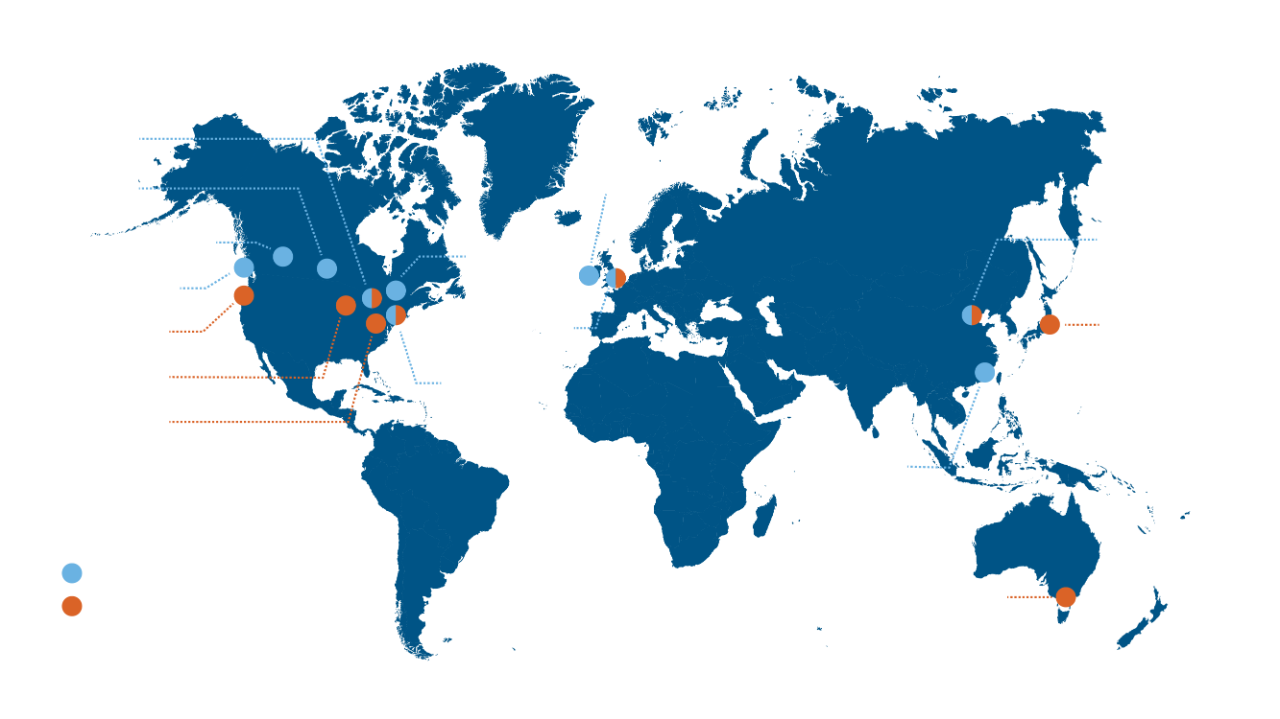

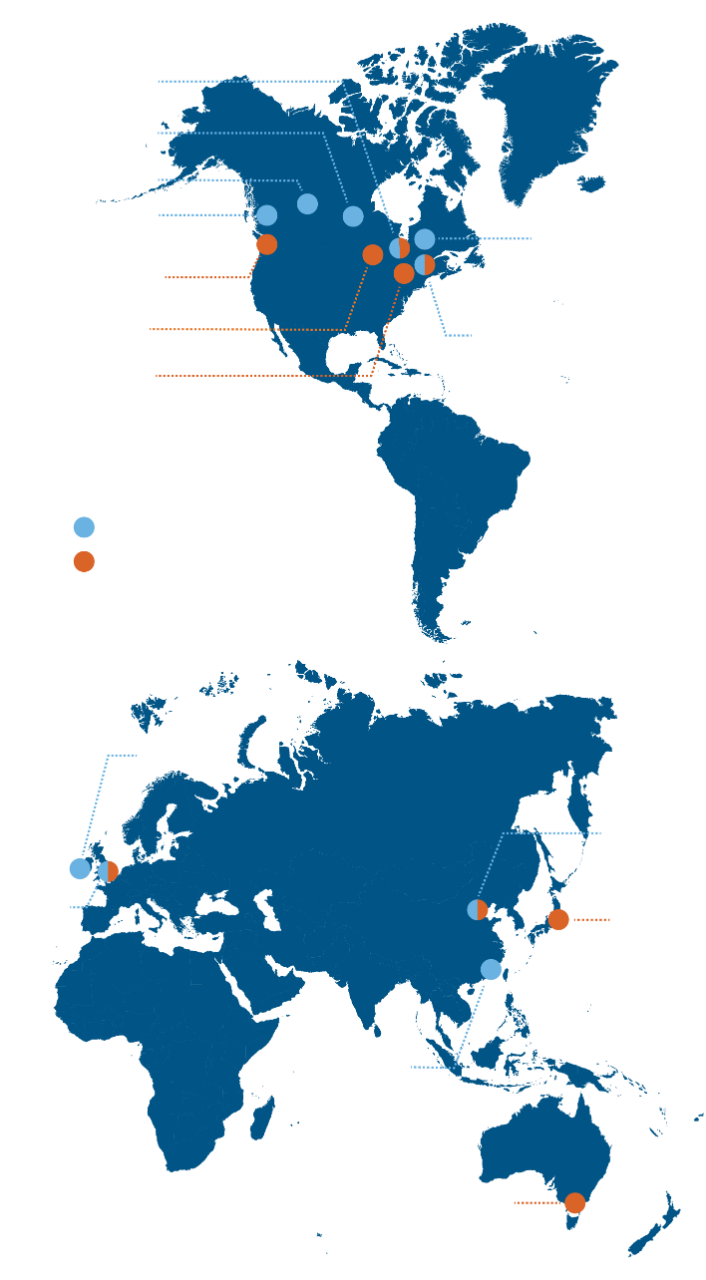

Leveraging the resources of Power Corporation, we operate specialized investment teams worldwide, delivering exceptional solutions to Canadian and international clients.

Since our founding in 1967, Mackenzie Investments has developed deep experience as a premier Canadian global asset manager.

We combine the advantages of specialized investment boutiques with the strength and resources of one of Canada’s largest independent asset management firms to offer diverse solutions across key asset classes and investment vehicles.

At Mackenzie as of Mar 2025

Investment professionals

Specialized boutiques

Leveraging the resources of Power Corporation, we operate specialized investment teams worldwide, delivering exceptional solutions to Canadian and international clients.

Our 16 distinct investment boutiques, combined with extensive resources, allow us to navigate diverse market conditions and provide tailored solutions.

We offer cutting-edge solutions to help clients achieve long-term financial goals, spanning investment vehicles, asset classes and strategies.

Our expertise is enhanced by our ownership structure. As part of IGM Financial, a subsidiary of Power Corporation, we benefit from a 100-year legacy and the financial strength and scale of one of Canada’s largest companies. This relationship allows us to leverage expertise and partnerships across Power Corporation's diverse portfolio, including Canada Life, Irish Life, Portage Ventures, Rockefeller Capital Management and Power Sustainable.

Our 16 distinct investment boutiques, combined with extensive resources, allow us to navigate diverse market conditions and provide tailored solutions.

We let our experienced asset managers do what they do best — develop investment strategies that deliver the most value for your mandate.

We empower our asset managers with direct ownership over their own process, research and investment decisions.

We provide our asset managers with the tools, support and flexibility they need to succeed and build strategies to suit your goals.

Mackenzie offers comprehensive investment strategies managed by leading professionals. We provide diverse options across investment vehicles, asset classes and strategies.

We believe in a core style of investing that employs advanced quantitative methods to exploit market inefficiencies, focusing on generating alpha through a risk-aware investment approach across diverse market environments.

A sustainable future requires resources. We seek opportunities across traditional, evolving and future-facing resource companies, allowing investors to support positive change while meeting investment objectives.

We seek to deliver both alpha and diversification advantages by uncovering the "best ideas" worldwide and investing in companies positively exposed to the energy transition.